Date Published: April 22, 2025

When someone dies, especially someone who struggled, it’s easy to focus only on the pain.

But sometimes—if we’re intentional—we can turn even the loss into a beginning.

Ray, the father of two of my boys, is dying.

He knows it. I know it. Our boys are starting to understand.

And as hard as that is, I’ve shifted into something that feels empowering: preparing for what comes next in a way that protects our children not just emotionally, but financially.

Ray paid into Social Security for his entire working life.

When he dies, my boys will be eligible to receive monthly survivor benefits until they’re 18 (or 19 if still in high school). For many families, that money is essential for daily expenses.

But for us, it doesn’t need to be. And that changes everything.

We’re turning this into a legacy.

Here’s what I’m doing:

1. I’m creating a trust for each child.

Not a savings account. Not a custodial brokerage that unlocks at 18.

A trust—with rules and structure that protect their future.

This will allow me to:

- Decide when they get access (not at 18—not even 25—more like 40 or beyond)

- Protect the funds from impulsive decisions

- Allow the money to grow over decades

This isn’t money for college or a car or a first apartment.

This is money for:

- Retirement

- Their own children’s education

- Freedom to make long-term choices instead of short-term financial compromises

2. The money will be invested.

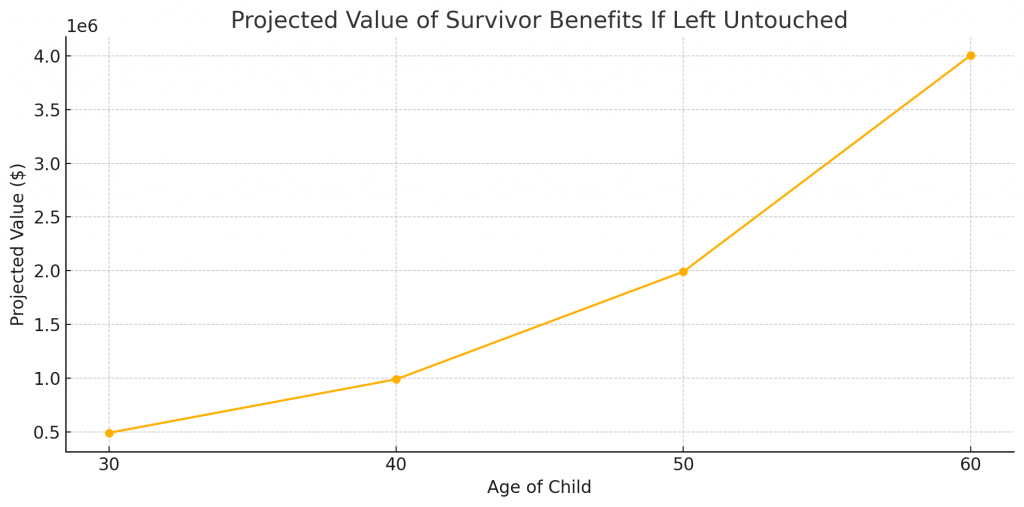

If we save $1,000 per month for each child for 10 years and invest it with a long-term view, here’s what each of their accounts could grow into if untouched:

| Age of Child | Projected Value |

|---|---|

| Age 30 | $493,000 |

| Age 40 | $991,000 |

| Age 50 | $2 million |

| Age 60 | $4 million |

These numbers reflect one child’s trust, assuming consistent contributions and a 7% annual return. If both boys receive the same amount, the impact is essentially doubled across two legacies.

That’s the power of compounding interest + time + discipline.

And that’s what makes this more than just a benefit—it becomes a long-term gift from their father. Not for childhood needs, but for adult freedom.

3. Ray is writing them a letter.

It will be kept inside the trust.

A message from their dad—one they’ll open later in life. Maybe when they become parents themselves.

It won’t be perfect. But it will be honest. And it will matter.

“I couldn’t stay. But I left you something. I loved you. And I wanted you to have a future.”

This is what legacy looks like to me.

It’s not just about building wealth—it’s about healing what was broken.

It’s about giving the next generation tools, security, and a sense of continuity.

It’s about saying:

“You don’t have to start from scratch. You get to start from love.”

Ray is dying.

But his name will live on through something beautiful.

Something his children will carry with them.

And one day, maybe his grandchildren too.

And I’ll say this:

There’s something strangely comforting about getting the paperwork in order.

About setting up the trust.

About turning Social Security benefits into long-term legacy.

It doesn’t make the loss easier—but it gives it shape.

And in a season that’s all about letting go, this part—this planning—helps me hold something steady.

If you’re navigating loss, or preparing for someone’s passing, know this:

There are ways to make it meaningful. You’re not alone.

Read the first part of this story: Preparing for Ray’s Death